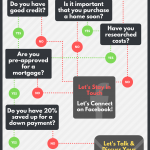

Quiz: Are you ready to Rent or Buy?

June 14, 2019

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams

Having been a top producer since 1996, I empower every client with my knowledge to help them make the best decision. Over 70% of my business is from repeat clients and referrals from past clients and other professionals. Your best interests are my priority, hence my strong marketing and negotiating skills. I treat you the way I want to be treated.

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams10 hours ago

Spring is a busy season for buying and selling—but did you know an appraisal can be the deciding factor in your sale? Here’s why:

📈 Rising prices impact appraisals: A hot market can drive home prices up fast, but if an appraisal comes in lower than the offer, buyers may need to renegotiate or cover the gap.

🏡 Comparable sales matter: Appraisers look at recent sales in the area, but if homes haven’t caught up with market trends, valuations might not reflect current demand.

💰 A strong appraisal helps both sides: Sellers get a fair price, and buyers secure financing with confidence.

Considering selling this spring?

Let’s talk about pricing strategies to avoid surprises! 📩

#realestate #homeappraisal #springmarket #homevalue

📈 Rising prices impact appraisals: A hot market can drive home prices up fast, but if an appraisal comes in lower than the offer, buyers may need to renegotiate or cover the gap.

🏡 Comparable sales matter: Appraisers look at recent sales in the area, but if homes haven’t caught up with market trends, valuations might not reflect current demand.

💰 A strong appraisal helps both sides: Sellers get a fair price, and buyers secure financing with confidence.

Considering selling this spring?

Let’s talk about pricing strategies to avoid surprises! 📩

#realestate #homeappraisal #springmarket #homevalue

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams1 day ago

Buying your first home? Avoid these common mistakes that can cost you time and money!

1️⃣ Skipping pre-approval – Without pre-approval, sellers may not take your offer seriously, and you could miss out on your dream home.

2️⃣ Waiving the home inspection – Small issues can turn into expensive repairs. Always get a professional inspection.

3️⃣ Overextending your budget – Just because you qualify for a higher loan doesn’t mean you should take it. A comfortable mortgage = a stress-free future!

Which mistake do you see buyers making the most? Drop a number in the comments 👇

#firsttimebuyer #realestatetips #homebuyingguide #newhome #homesforsale

1️⃣ Skipping pre-approval – Without pre-approval, sellers may not take your offer seriously, and you could miss out on your dream home.

2️⃣ Waiving the home inspection – Small issues can turn into expensive repairs. Always get a professional inspection.

3️⃣ Overextending your budget – Just because you qualify for a higher loan doesn’t mean you should take it. A comfortable mortgage = a stress-free future!

Which mistake do you see buyers making the most? Drop a number in the comments 👇

#firsttimebuyer #realestatetips #homebuyingguide #newhome #homesforsale

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams2 days ago

Money may be tight, but when it comes to quality, boosting your budget for certain items will be worth it.

5 Household Items You Can Feel Good About Splurging On

There’s nothing wrong with spending a little extra when it comes to furnishing your home. No matter ...

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams2 days ago

Want your home to stand out during peak home-buying season? Here’s how to make a great impression:

✨ Boost curb appeal with fresh mulch, trimmed landscaping, and a welcoming entryway. These small details go (surprisingly) a long way!

🛋 Keep it cool & bright with a comfortable indoor temperature and natural light to make the space feel all the more inviting.

🌿 Highlight outdoor spaces by showcasing patios, decks, or gardens—buyers love outdoor living potential.

🧼 Declutter & depersonalize with a clean, neutral space that helps buyers instantly envision themselves living there.

🏡 Stage with the season in mind with light, airy decor and fresh flowers to create a summer-ready feel.

What’s your favorite way to make a home feel more inviting? Let me know in the comments! ⬇️

#homeselling #summermarket #realestate #curbappeal #dreamhome

✨ Boost curb appeal with fresh mulch, trimmed landscaping, and a welcoming entryway. These small details go (surprisingly) a long way!

🛋 Keep it cool & bright with a comfortable indoor temperature and natural light to make the space feel all the more inviting.

🌿 Highlight outdoor spaces by showcasing patios, decks, or gardens—buyers love outdoor living potential.

🧼 Declutter & depersonalize with a clean, neutral space that helps buyers instantly envision themselves living there.

🏡 Stage with the season in mind with light, airy decor and fresh flowers to create a summer-ready feel.

What’s your favorite way to make a home feel more inviting? Let me know in the comments! ⬇️

#homeselling #summermarket #realestate #curbappeal #dreamhome

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams3 days ago

Closing costs are more than just an extra line on your bill—they’re essential to finalizing your home purchase. Here’s what they typically include:

🏡 Loan-related fees: Lender charges, underwriting fees, and points (if you buy down your rate).

📜 Title & escrow costs: Title search, title insurance, and escrow services to ensure a smooth transfer.

🔍 Inspection & appraisal: These verify the home’s condition and market value before closing.

🏛 Government fees: Taxes, recording fees, and any applicable state-specific costs.

On average, closing costs range from 2% to 5% of the home’s price—so be sure to budget accordingly!

Need help breaking them down? Let’s chat 📩

#homebuyingtips #closingcosts #realestate #firsttimebuyer

🏡 Loan-related fees: Lender charges, underwriting fees, and points (if you buy down your rate).

📜 Title & escrow costs: Title search, title insurance, and escrow services to ensure a smooth transfer.

🔍 Inspection & appraisal: These verify the home’s condition and market value before closing.

🏛 Government fees: Taxes, recording fees, and any applicable state-specific costs.

On average, closing costs range from 2% to 5% of the home’s price—so be sure to budget accordingly!

Need help breaking them down? Let’s chat 📩

#homebuyingtips #closingcosts #realestate #firsttimebuyer

Francine Dupont - Realtor - Dupont Real Estate Corp / Keller Williams4 days ago

Buying a fixer-upper can be a great investment—but is it the right move for you this year? Let’s break it down:

💰 Upfront savings, long-term costs: While fixer-uppers often have lower price tags, renovations can add up quickly. Factor in labor, materials, and unexpected surprises.

📈 Market trends matter: In 2025, rising construction costs and labor shortages may impact renovation timelines and budgets.

🏡 Customization vs. convenience: If you love the idea of designing your dream home, a fixer-upper could be worth it. But if you need a move-in-ready space, a turnkey home might be a better fit.

Would you take on a fixer-upper, or do you prefer a home that’s move-in ready?

Drop your thoughts below! ⬇️

#realestate #fixerupper #homebuying #investment

💰 Upfront savings, long-term costs: While fixer-uppers often have lower price tags, renovations can add up quickly. Factor in labor, materials, and unexpected surprises.

📈 Market trends matter: In 2025, rising construction costs and labor shortages may impact renovation timelines and budgets.

🏡 Customization vs. convenience: If you love the idea of designing your dream home, a fixer-upper could be worth it. But if you need a move-in-ready space, a turnkey home might be a better fit.

Would you take on a fixer-upper, or do you prefer a home that’s move-in ready?

Drop your thoughts below! ⬇️

#realestate #fixerupper #homebuying #investment

Why We Aren’t Headed for a Housing Crash

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the ...

The 4-1-1 of Contingencies

A word that anyone who is going through a house sale should know is “contingency.” And along with that, understand that just because a bid ...